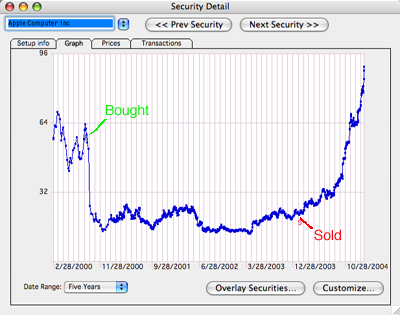

(Note: The date scale on the chart is wrong. Damn bugs in Quicken. It actually shows 17 Feb 2000 to 16 Feb 2005 for AAPL.)

Yup, my investing skills rock!! I am awesome!

To my credit though, I had no intention of selling. It wasn’t because I didn’t think Apple would come back. I was sure it would actually. My plan had actually been to never sell any stock I ever bought, just keep it for decades and decades and see what happened. Well, at least to never sell it because of how it was doing, but rather only if I needed the cash for something. I *wanted* to keep it. But in early 2004 what with being unemployed and all at the time, I did indeed need a jolt of cash. So while I kept some mutual funds, I sold all but one share each of each of the stocks I had at the time. I kept those single shares just for sentiments sake, and also just to make me keep watching “what if” I had kept the rest.

*EVERYTHING* I sold at that point (with the exception of Tivo) has gone up. Some quite nicely. But Apple… OUCH! My timing was just about perfect on that one. I bought it mere weeks before it crashed through the floor. Then I sold it mere weeks before it skyrocketed through the ceiling. Go me!!

Oh well! I’m sure I’ll get to the point where I am all set to be buying again, load up on some Apple again, just in time for it to crash again. :-) [To be fair to myself, I’ve had some good timing too, I did very nicely on GRMN, more than doubling my money in a relatively short time… although I would have made even more keeping it longer.] But on Apple… once more, OUCH!

But hey, on the flip side, last night coming home on the plane they upgraded me to first class for no apperant reason, so that was cool.

Oh yeah, and while I won’t post anything here before she posts herself, I hear the Jackal will have some news before that much longer. :-)

I feel your pain, Sam. There was a period (years) where I could do no right in the stock market. The tickers are too numerous to list, and besides only really serve to say “look at me, I used to own stock in this company and that company” anyway.

The best one, without a doubt, was Lernout & Hauspie Speech Products. They were true innovators in the field of corporate malfeasance. Before Worldcom, and even before Enron, there was LHSP. And I was invested in them. I think I bought them in the $40’s… and now? Well, a few weeks ago I got the notice of the court settlement so I can get a couple bucks/share back.

Anyway, lately my luck has changed and my picks have been doing a lot better than the market… So I guess I can’t complain any more, just reminisce.

To my credit I bought 1400 shares of apple at a split adjusted price of 6 and 9. You need any money?

I’ve done OK overall. Some up, some down. My worst in terms of % down was VIGN. That was bad. But I only ever got 10 shares, so no biggie.

My overall ROI on AAPL was -61%. It was not my worst investment by far though. That was VIGN. My ROI there was -97.8%. So far.

I’ve had some good ones too. My ROI on GRMN was +96.2%. That’s my best so far. Although there are a couple that are close on its heels.

Out of 52 holdings in my portfolio at the moment, 33 have a positive ROI at the moment, while 19 are in the red.